An all-in-one guide for the retail investors for protection and growth of their wealth.

By the current world situation it has become even more essential for a given person or even a household to look for ways on how he or she or them respectively is or are going to plan for their future financially. Due to the increase of the life span and instability of the economy in some states individuals try to do everything to protect his/her own wallet and the wallets of the closest people. Taking into consideration the events that can be performed in order to maintain the financial security one can name only life insurance and savings plans as the basic fundamentals. These instruments differ from the ordinary insurance services by not only protecting from the unpredictable incidents and offering the security but also giving the possibility to increase the sum of money.

This article will attempt to discuss the reasons for life insurance and savings, the various categories of life insurance and savings, how it works, advantages for each, how one’s hard earned money will be assisted and how one’s family will be financially secure.

Understanding Life Insurance:

Life insurance is a contractual relationship in which the person insured pays a fixed sum of money to the insurance company and aside from this promises that his/her beneficiaries shall receive a large sum of money after his/her death. The payout can cater for certain expense such as funerals, outstanding bills among other incidences.

Types of Life Insurance:

Hence, there are many modified life insurance contracts that would do this and meet other financial needs. The most common types include: There are many different types of violence, but the most frequently addressed types are the following:

Term Life Insurance: Term life insurance ensures the client a plan for a specific period say ten, twenty or thirty years. Where the policyholder dies within the term, the nominees, in other of terms the beneficiaries receive the death benefit. The standard term policies are less expensive compared to permanent life insurance but they do not have the cash – value accumulation or investment aspect. 2. Whole Life Insurance: There are different types of insurance where whole life insurance remains lifespan of the policy holder starting from the moment of agreement and reception of cash till the insured’s life.

Components to Consider; first is the face amount or the amount that is payable upon the death of the insured and second is the face value that increases or builds up every year. This serves the purpose of a cash equivalent since it can be cashed against or borrowed to, thus becomes an extra cash stock.

Universal Life Insurance: Universal life insurance is extremely similar to whole life insurance however it contains certain changes that are integrated into the policy between the buyer and the insurance company. While fixed and variable premiums may be demanded or can be changed by insurers, these may be offered by policyholders at the profit of, or in exchange for, other concessions. It has an aspect of cash value with feature of market interest rate for policy and investment returns.

Variable Life Insurance: Variable life insurance is a policy, which connects a death benefit charge with an investment choice. The policyholders have the chance to choose that cash value to reinvest in for instance the stock or bond so as to make it rich. Though these come with higher risk as the cash value is associated with the market share and the cash value is thus not fixed.

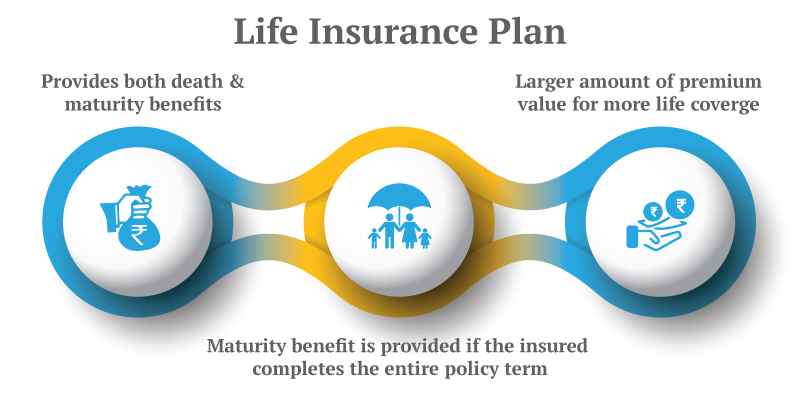

Endowment Plans: These are insurance plans that very usual payout on any one eventuality including the policyholder’s death or at the expiration of the policy period, whichever is first. They can then pay for both the life coverage as well as the saving factor hence it will ensure that it will be useful for certain goals such the need to save for college or retirement.

The implications of life insurance: The implications of life insurance:

And, thus, life insurance is not merely a commodity: Life insurance is a solution that assists to avoid thinking about certain issues. Here are some reasons why life insurance is vital:The following are some of why life insurance is important:

Income Replacement: You also assume the role of being the bread winner where you are supposed to provide for your family; in your failure this role is left.

result in financial problems. As for this, it is exactly thus: through the life insurance your family obtains a certain amount which allows them to live in the same way as it was before.

Debt Repayment: Whenever you die, whether it is heart failure, and your family is left with the house mortgages, or car loans they remain unpaid. For this reason, life insurance has a function of meeting such costs so that your family will not be in a position to.

Funeral and Burial Costs: Funerals are not very cheap as may range from hundreds, if not thousands of dollars depending on the plans that have been laid down. All these cost can be catered for by life insurance which can do a lot in helping the family during those moment.

Inheritance and Estate Planning: Flamini makes it clear that death benefits mean that life insurance works as a ‘transfer of wealth’ to your family or loved ones. It can also be used for Estate Planning where one would wish to transfer his wealth through the death of a person.

Savings Plans: Thumbnail An Analysis of the Creation of Wealth In the Future

The face amount linked with the life policies are in fact the savings schemes by which the cash value is accumulated over some time. These plans build primal saving health and in addition facilitate the Picture for the performance of long haul saving anticipations. Savings plans are normally better than normal savings accounts since they pay higher returns and more, are tax exempted.

Savings Plans: Savings solutions: The accumulation of assets for the future, could be in parallel with life insurance products. These plans instill disciplined saving regimes and come with recommendations on how to achieve laid down longer-term targets. Savings plan also differs from simple saving accounts in the fact that they give better returns and are tax efficient to the investor.

Types of Savings Plans:

Savings plans can be classified into several categories based on their structure, returns, and purpose:Savings plans can be classified into several categories based on their structure, returns, and purpose:

Traditional Savings Plans: These are simple, guaranteed surrender endowment policies in which policyholder pays periodically – monthly or yearly and gets a definite amount in the event of surrender.

specific period. In this terminal payout the policyholder gets the money accumulated in the policy plus the contributions and the interest and or bonuses if any.

Unit-Linked Insurance Plans (ULIPs): ULIPs are the products that have aspects of life insurance as well as have investment plans integrated in them. The first is the amount that is used to pay for the life coverage, the rest of it is reinvested through the purchasing of shares, debentures, or mutual investment such as shares, bonds, or mutual funds. These returns are associated with the profitability of the above investments thus categorizing ULIPs as being high risk, high return.

Retirement Plans: They are investment instruments produced and managed for the purpose of earning earnings and income to the holders during their retirement age. Policyholders pay premiums throughout their working period and when they reach the retirement age they either get a onetime pay or monthly or yearly payments. Retirement policies are of two types namely; deferred policies, which means that payouts start after a given period has been reached and immediate policies where payouts are available shortly after the policy has been purchased.

Child Education Plans: These are saving pest schemes, which are targeted at saving enough money to cater for the child’s education needs. The policyholder pays in gradually and the tede policy matures when the child gets to a certain age. The payout can be employed for paying tuition fees, textbooks, and all the other expenses that are relevant to education.

Public Provident Fund (PPF): In some countries, the government provides savings by various schemes like PPF in which investment has tax advantages with assured rate of returns. As an insurance product PPF is not directly associated with insurance yet it is quite similar to a low risk long term investment program associated with insurance commonly used along side life insurance policies.