A popular investment among the French, life insurance proves to be relevant when you want to finance a medium and long-term project, prepare for your retirement and your inheritance. Life insurance has many advantages: tax deductions, capital offerings. Speeches of the.

What is the principle of life insurance?

Life insurance is a contract by which the insurer undertakes, in return for the payment of premiums, to pay an annuity or capital to the insured or their beneficiaries. Life insurance is a long-term or long-term investment.

After opening the contract with an initial payment, it is possible to make payments, regular or not, with no limit on the amount. Even if it is fiscally more interesting to save for at least eight years, you have the right to close your contract or make withdrawals at any time by recovering the amounts invested increased by any gains and reduced by fees (administration, management, payments, arbitration).

The major types of agreements

contracts approved once

Your payments are invested in a euro fund . Less risky products, such as government bonds, are also subsidized annually. The invested capital is guaranteed at all times and the interest for the year is definitively acquired.

Multi-support contracts

Your payments are invested in risk-free products and also products linked to the stock market ( bonds , shares , funds, SICAVs, etc.), invested in the financial markets, called account units (UC) . The insurer does not guarantee the value of these units, which varies, but their number. This investment is riskier than euro funds but it can be more profitable. Before investing in units of account, it is important to define your investor profile and ensure that you. banker or insurer with whom you are taking out the contract.

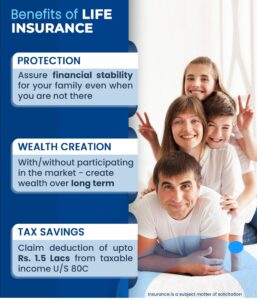

The benefits of life insurance

Life insurance offers many benefits

It allows you to build up capital over the long term . After a few years, you can withdraw your capital, i.e. close your contract and withdraw the money deposited, plus net winnings. Be careful! You have no guarantee of getting your entire stake back if you invest in units of account (UC) . It also offers the possibility of supplementing your income, particularly for retirement, by Regular withdrawals or converting your capital into a lifetime annuity . The annuity is calculated by your insurance company based on your capital and age.

If you choose to receive a life annuity, you will no longer be able to recover the capital from your life insurance contract or pass it on to beneficiaries. Finally, life insurance is an excellent tool for passing on one’s assets thanks to advantageous taxation and great freedom in choosing beneficiaries.

Life Insurance: What is the tax?

Interest from payments made since September, 2017 on your life insurance contract is subject to the single flat-rate deduction (PFU) .The single flat-rate deduction (PFU) occurs when the sums available on your life insurance contract are partially or completely withdrawn. For a withdrawal from a life insurance contract occurring eight years after its opening , the flat-rate deduction amounts to 20.7% (including 5.5% for income tax and 15.2% for social security contributions) for amounts paid less than €160,000. You also benefit from an annual allowance of €5,600 (€8,200 for a married couple) on the gains generated if your contract is more than eight years old.

For a withdrawal from a life insurance contract occurring less than eight years after its opening, the single flat-rate deduction amounts to 35% (including 10.8% in income tax and 15. 2% of Social Security contributions.).

You may be exempt from any tax on winnings if you are in one of the following situations:

- dismissal (provided you are registered with Pôle Emploi),

- cessation of non-salaried activity following a liquidation judgment,

- early retirement,

- 2nd or 3rd category disability of Social Security.

What taxation for heirs?

At the time of the death of the life insurance policyholder, the amounts paid to the beneficiary of the contract are not part of the deceased’s estate . This particularity of life insurance allows you to benefit one or more people (even if they are not related) by transferring capital that can amount to up to 155,500 euros per beneficiary without having to pay inheritance tax .

- The specific taxation of life insurance during a transfer depends on three factors:

- the date of opening of the contract,

- the date of payment of the bonuses,

your age at the time of payment of the premiums (before or after your 65th birthday). If the beneficiary of your contract is your spouse or civil partner, your brothers and sisters (under certain conditions), he or she will not be liable for any inheritance tax, even if you paid into your contract after the age of 70 to 80.

For other beneficiaries, the tax treatment varies depending on the age of the insured at the time of payment of the premiums :

- for amounts paid before the age of 70 to 80 : after application of the allowance of €155,500 per beneficiary, the capital is taxed at 15% for the taxable portion of each beneficiary up to €750,000 . Beyond this ceiling, the tax rate rises to 30.25%

- for amounts paid after the age of 70 to 80: a single allowance of €30,800 applies regardless of the number of beneficiaries. Beyond this, the capital paid is reincorporated into the estate assets. However, capitalized interest is exempt.

The duty to advise

The insurer is required to inform you of the characteristics of the products it sells you. Since 2009, as with any other financial product, the intermediary who sells life insurance must inquire about your objectives and sell you a product adapted to your needs.

1 thought on “Why a Life Insurance Contract?”